Build an open insurance ecosystem with APIs and Red Hat software

An open insurance ecosystem helps you deliver high-value services using APIs

Widespread availability of digital technologies and services continues to transform nearly all industries. Policyholders expect high-quality, personalized digital services in all aspects of their lives — including insurance — and are quick to consider competitors’ services if their needs are not met. Insurance providers must deliver valuable, engaging services to their policyholders to remain competitive. Even so, no single insurer can develop the multitude of required services themselves. Insurers must collaborate with partners to create multifaceted customer experiences.

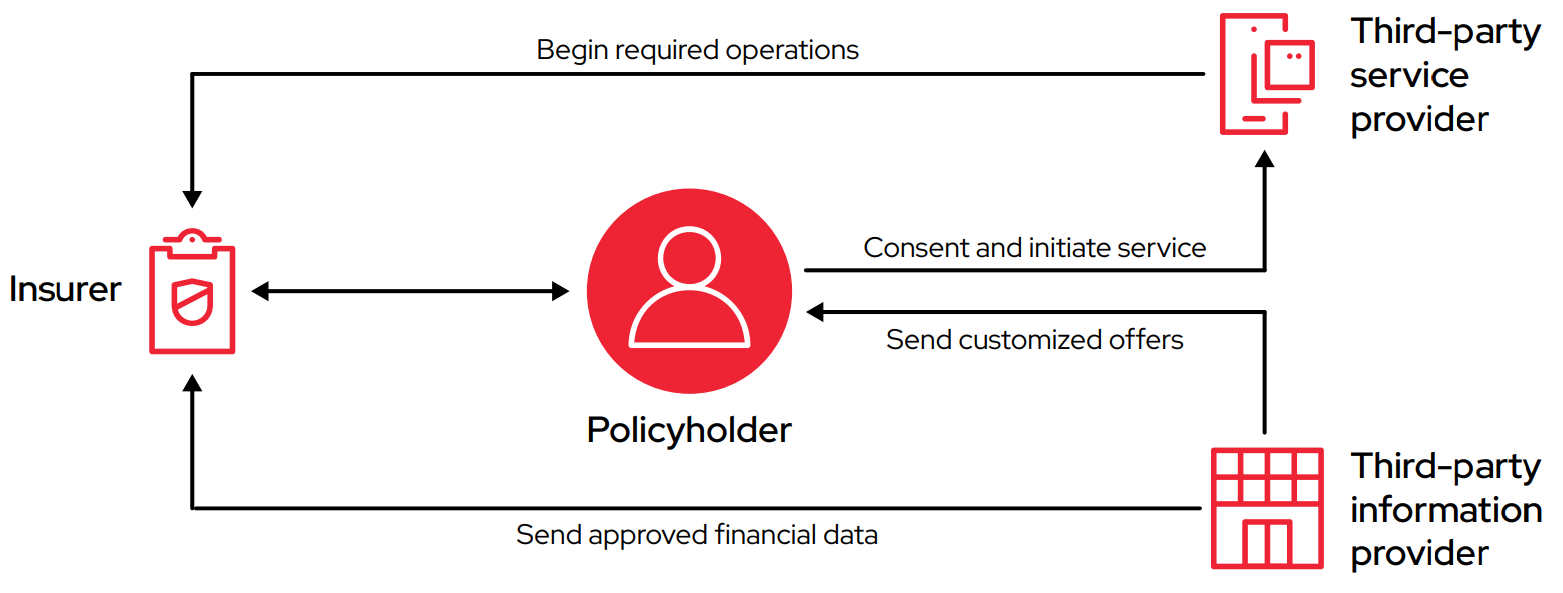

An open insurance ecosystem — where partners use application programming interfaces (APIs) to develop and connect rich digital experiences — can build valuable relationships with customers and partners alike. These partners include other insurance companies, financial services organizations, insurtech companies, and third-party service providers from other industries. Whether you assemble your own or connect with another established ecosystem, your organization can gain many benefits:

- Deliver the innovative, integrated services and experiences that policyholders want.

- Adopt new business and delivery models to expand revenue opportunities.

- Employ partner capabilities and emerging technologies to create new services faster, boost efficiency, and promote innovation.

- Monetize your assets by providing controlled, authorized third-party access to your own services and to customer data.

Considerations for creating an open insurance ecosystem

Open business platforms and APIs are critical for ecosystem initiatives. An open platform provides a place for teams across your organization to collaborate and work toward joint goals. Open APIs connect services, products, and data to create comprehensive products and offerings. These connections also allow authorized financial institutions and partners to access pre-approved policyholder data, transforming the relationships between insurers, third-party firms, and customers.

To build your open insurance ecosystem and effectively use APIs, you need to consider your business initiatives, operational model, and technology foundation.

Common use cases for open insurance ecosystems

Open insurance ecosystems support new business models and use cases, including:

- Parametric insurance offerings for travel, real estate, business, and more.

- Automatic insurance quotes for automobiles, real estate, pets, and others.

- Streamlined policy acceptance for immediate coverage at points of sale.

- Data- and sensor-driven pricing and adjustments.

- Straight-through claims processing.

- Brokerage product management.

Business initiatives

Business initiatives are at the core of your open ecosystem strategy. The first step in creating any strategy is to understand and define your goals and expected outcomes. Keep in mind that objectives may not be the same for every partner and service. Nonetheless, an overarching strategy is essential for maintaining a high level of consistency and efficiency.

When establishing your open ecosystem strategy, consider how your organization will:

- Improve customer experiences using policyholder data.

- Provide secure, authorized access to data so that third parties can create and deliver services directly to policyholders.

- Establish best practices and collaborate with partners using open APIs and platforms.

- Connect to and work with third-party developers via catalogs of APIs and developer portals.

- Meet and respond to changing regulatory requirements and industry standards.

Develop an operational model that can adapt

Your operational model defines how your organization will use technology to achieve your business initiatives. Assessing your operational strengths, weaknesses, and objectives can help you choose the right technology and platforms for your organization.

When defining your operational model, consider how your organization will:

- Adjust and optimize your processes over time.

- Adapt to new technologies, business initiatives, and organizational changes.

- Achieve compliance with security and governance requirements for open APIs and data exchange.

- Attract, develop, and retain staff and partners with the desired skills, experiences, and potential.

Build a technology foundation that can build value with APIs

Your technology foundation provides the tools and capabilities for implementing your operational model and achieving your business initiatives.

When building your technology foundation, look for solutions that provide:

- Comprehensive API management capabilities, including authentication, authorization, policy enforcement, rate limiting, developer portals, life-cycle administration, and analytics.

- Advanced, layered security capabilities that span your entire environment and align with hybrid cloud operational models.

- Integration with your existing systems, new technologies, and third-party products.

- Real-time messaging and data-driven architectures to accelerate processes and workflows.

- Developer-friendly tools for building, testing, and deploying APIs and collaborating with other developers, teams, and organizations.

Tip

Read the Open APIs in Financial Services for Dummies e-book to learn more about using APIs within insurance and other financial services organizations.

Build an innovative, adaptable foundation for your open insurance ecosystem

Mainframes and legacy systems do not provide the agility and scalability needed to support a complex API ecosystem. To build an effective technology foundation for your open insurance ecosystem, you need a flexible, modern infrastructure that integrates with your existing systems and with partner services and systems. Consistent API and services monitoring, security, and deployment are also critical. Finally, your ecosystem technology foundation should align with your larger core modernization efforts, as both initiatives have similar requirements.

Red Hat offers an enterprise open source technology foundation that meets all of these needs and helps you focus on delivering valuable, differentiated services to your policyholders. As an enterprise open source leader, Red Hat has the technical expertise, extensive experience, and innovative hybrid cloud solutions needed to successfully implement open ecosystems strategies. Red Hat’s flexible, integrated products allow you to build complete service management solutions using APIs, microservices, and your existing services. A modular, integrated architecture lets you deploy the components you need now, connect with existing systems, and expand as needs change. Finally, a large certified partner ecosystem and open source interoperability allow you to confidently customize and adapt your foundation.

- Red Hat® Enterprise Linux® is an open source operating system that provides consistency for deploying applications across bare-metal, virtual, container, cloud, and edge environments.

- Red Hat OpenShift® is a scalable hybrid cloud container platform that helps IT development and operations teams work together to deliver and manage microservices-based applications. It supports containerized, legacy, and cloud-native applications and provides everything you need to construct a microservices foundation, including built-in security capabilities, monitoring, logging, and service and resource management.

- Red Hat OpenShift Service Mesh — included with Red Hat OpenShift — provides a uniform way to connect, manage, and observe microservices-based applications. It incorporates a set of open source projects for integrated, managing, tracing, monitoring, and analyzing traffic between microservices. It also includes multiple networking interfaces and integrates with Red Hat 3scale API Management, allowing you to create APIs that govern access to service mesh backends.

- Red Hat Integration is a comprehensive set of integration and messaging technologies that connect applications and data across hybrid infrastructures. It is an agile, distributed, containerized, and API-centric solution. Red Hat Integration provides service composition and orchestration, application connectivity and data transformation, real-time message streaming, change data capture, and API management — all combined with a cloud-native platform and toolchain to support the full spectrum of modern application development. Key technologies within Red Hat Integration include Red Hat 3scale API Management and Red Hat AMQ.

- Red Hat 3scale API Management allows you to share, secure, distribute, control, and monetize your APIs on an infrastructure platform built for performance, customer control, and future growth. It integrates with Red Hat OpenShift Service Mesh via the Red Hat 3scale Istio plugin, allowing you to set up APIs with service mesh backends.

- Red Hat AMQ is a flexible messaging platform that delivers information reliably, permitting real-time integration and connecting the Internet of Things (IoT).

- Red Hat Single Sign-On is an identity provider solution that implements federated authentication for web applications, mobile applications, and RESTful web services. It allows you to protect your APIs and applications via security tokens based on popular standards like OpenID Connect and OAuth 2.0.

Figure 2 shows an overview of an open API and business platform architecture using Red Hat technologies.

Tip

Read the Build a foundation for flexibility overview to learn about modernizing your core insurance systems with Red Hat.

Service mesh or API management?

Service mesh and API management technologies are complementary technologies that work together to deliver a complete service management architecture.

Read the Service mesh or API management? e-book to learn how you can accelerate new service development, speed application launch cycles, and deliver real-time, data-based services to users.

Get started faster with managed services

Reduce complexity and focus on business value with Red Hat OpenShift Dedicated, a fully managed service of Red Hat OpenShift, and Red Hat OpenShift API Management, a hosted and managed API administration service.

Key functional areas of the solution include:

- Open container platform. The API and microservices architecture is deployed within Red Hat OpenShift, with connections to data and event feeds, authorized business partners and users, traditional core systems, databases, and storage.

- Event streaming pipeline. Data and event feeds are integrated into a unified pipeline using Red Hat Integration and Red Hat AMQ.

- Service mesh. Red Hat OpenShift Service Mesh contains microservices for common core and product functions like payment, account balance, fraud evaluation, and transaction authorization services. You can connect your traditional services, create new microservices internally, or purchase and integrate third-party offerings into the service mesh.

- Agile integration. Other supporting systems and functions are connected to the new systems through Red Hat Fuse.

- API management. APIs for connecting business partners and other authorized users to the new architecture, as well as other core systems and microservices, are centrally managed through Red Hat 3scale API Management.

- Figure 3 shows an overview of an open API and business platform architecture using Red Hat products and technologies.

We now have hundreds of APIs. Without the transparency and security features provided by 3scale API Management, we wouldn’t be able to comply with the rigorous data protection standards required by our partners, such as those for banks and other financial institutions.

Customer success highlight: Wiener osiguranje

Wiener osiguranje, a leading Croatian insurance provider, needed to simplify its growing API environment to maintain security and reduce management effort. By adopting Red Hat 3scale API Management, running in a flexible container-based environment on Red Hat OpenShift, the company has improved visibility into its hundreds of APIs. As a result, Wiener can enhance features, bring new services to market faster, and integrate with new partners while protecting its data and IT systems.

- Improved security with better visibility and control

- Reduced partner integration time from hours to minutes

- Enhanced API features with open API approach

Read the customer success story to learn more about Wiener’s experience.

Customer success highlight: Bajaj Allianz Life Insurance Company

Bajaj Allianz Life Insurance Company (BALIC), one of India’s leading private life insurance companies, wanted to take advantage of the massive potential of the country’s growing insurance market. To speed time to market and respond to opportunities faster, the company created a reliable microservices environment for digital applications using Red Hat OpenShift, supported by Red Hat 3scale API Management and Red Hat’s single sign-on (SSO) technology. Now, the company has reduced development and delivery time while eliminating downtime in its hybrid on-premise and public cloud environment.

- Improved time to market for new services and features

- Enhanced security using API management

- Eliminated downtime across hybrid IT environment

Read the customer success story to learn more about BALIC’s experience.

With Red Hat’s technology, we were able to create an efficient microservices-based environment to enhance business flow and at the same time, scale up our IT infrastructure, with minimum resources and a simpler access process.

Learn more with a free Red Hat Consulting Discovery Session

With an enterprise-grade open platform, you can access new revenue streams from digital ecosystems. As an open source leader with extensive experience supporting financial services firms, Red Hat helps you focus on providing valuable, differentiating services to your policyholders. Enhance your products and services, develop new partnerships and distribution channels, and improve your operational efficiency. Red Hat can help.

- Learn more: redhat.com/fsi

- Schedule a complementary discovery session: redhat.com/en/consulting-discovery-session